The other half of the profits are considered retained earnings because this is the amount of earnings the company kept or retained. If the retained earnings balance is gradually accumulating in size, this demonstrates a track record of profitability (and a more optimistic outlook). The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Step 2 of 3

- Retained Earnings (RE) are the part of a business’s profits that aren’t given to shareholders as dividends.

- The plot behind this step revolves around the outcome of your business’s operations.

- These payouts are like a “thank you” to the investors who bank on your success.

- Next, subtract the dividends you need to pay your owners or shareholders for 2021.

- Retained earnings is also known as the ending balance of a company’s statement of retained earnings.

If management believes the company needs capital to fuel growth, they’ll retain earnings instead of paying them out as dividends. If you aren’t overly familiar with financial statements, it can be hard to pinpoint which statement is useful for which purpose. If you find yourself wondering where your profits have gone off to, you need the statement of retained earnings.

- The retention ratio (or plowback ratio) is the proportion of earnings kept back in the business as retained earnings.

- Every month, when you get your salary or your pocket money, what is the immediate next step?

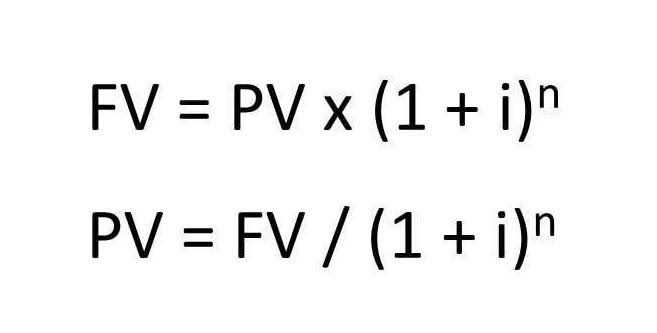

- The formula to calculate retained earnings starts by adding the prior period’s balance to the current period’s net income minus dividends.

- It begins with the beginning balance of retained earnings, adds net income from the income statement, and subtracts dividends paid to shareholders.

Significance of the Statement of Retained Earnings in Business

Non-cash items like write-downs, impairments, and stock-based compensation are the behind-the-scenes crew that also influence the plot. If your business currently pays shareholder dividends, you simply need to subtract them from your net income. Retained earnings are part of the profit that your business earns that is retained for future use. In https://x.com/BooksTimeInc publicly held companies, retained earnings reflects the profit a business has earned that has not been distributed to shareholders.

Relationship to the Balance Sheet

An overleveraged company may avoid paying dividends, but that doesn’t make the company a high-growth asset for the investor. Investors need to look at the company’s balance sheet to see the big picture. Sum up the figures added to the statement of retained earnings to calculate the closing balance.

Everything You Need To Master Financial Modeling

A deep understanding of how net income impacts retained earnings is essential for investors and analysts to accurately assess a company’s financial strength and future potential. Ignoring this interconnectedness can lead to misguided decisions and missed opportunities for growth and sustainability. When a company generates a profit, a portion of that profit is typically retained in the business rather than distributed to shareholders. This retained amount contributes to the company’s retained earnings, which is crucial for reinvesting in the business, financing growth opportunities, and ensuring stability during economic downturns. Dividends are treated as a debit, or reduction, in the retained earnings account whether they’ve been paid or not. Net income that is not included in accumulated retained earnings has been paid out to shareholders as dividends.

How to prepare a statement of retained earnings in 5 steps.

From there, the company’s net income—the “bottom line” of the income statement—is added to the prior period balance. The dotted red box in the shareholders’ equity section on the balance sheet is where the retained earnings line item is recorded. The steps to calculate retained earnings on the balance sheet for the current period are as follows. Generally, companies like to have positive net income and positive retained earnings, but this isn’t a hard-and-fast rule. The decision to pay dividends or retain earnings for future capital expenditures depends on many factors. Before you can include the net income in your statement of retained retained earnings statement template earnings, you need to prepare an income statement.

For https://www.bookstime.com/articles/asset-turnover-ratio-fomula-and-example example, any common stock you buy back during the year should be deducted from the earnings. Similarly, if you’ve decided to pay dividends, subtract dividends from the retained earnings. We have a comprehensive guide on the income statement where I explain how the net income is calculated.

Subtract the dividends, if paid, and then calculate a total for the statement of retained earnings. This is the amount of retained earnings that is posted to the retained earnings account on the 2020 balance sheet. On the other hand, the statement of stockholders’ equity shows how the balance of the shareholders’ equity account changed over the current accounting period.